Browsing the Process of Acquiring Hard Money Loans: What You Need to Know

Steering the process of acquiring Hard money Loans can be complicated. Borrowers should comprehend the distinct attributes and terms connected with these car loans. Trick steps consist of collecting financial papers and picking the best home for security. Evaluating prospective lenders is similarly crucial. With high rates of interest and brief repayment durations, mindful consideration is required. What methods can consumers implement to guarantee a successful experience with Hard money financing?

Understanding Hard Money Lendings: Definition and Secret Features

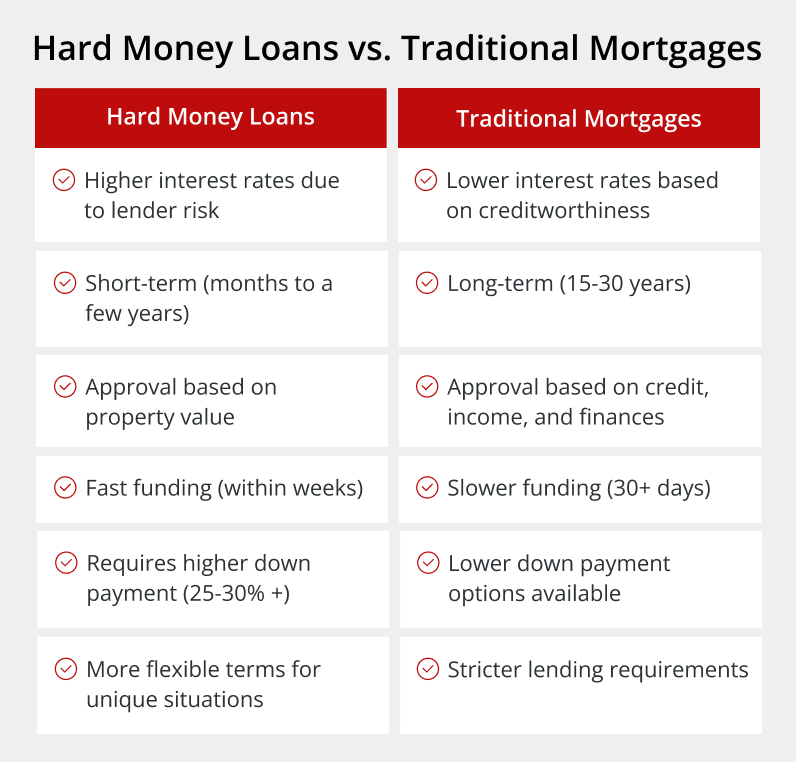

Hard money Loans serve as an economic lifeline for consumers seeking fast access to resources, particularly in actual estate purchases. These Loans are primarily secured by the worth of the property, as opposed to the customer's credit reliability. Generally used by personal financiers or business, Hard money Loans feature high-interest rates and brief settlement terms. They are often made use of for residential or commercial property flips, immediate restorations, or when typical funding is unattainable. Approval processes are quickened, permitting debtors to protect funding swiftly. Unlike traditional home loans, Hard money Loans count greatly on collateral, making them a viable alternative for financiers that need swift financing options. Recognizing these features is crucial for consumers thinking about Hard money Loans for their economic requirements.

The Application Process: Actions to Secure a Tough Money Car Loan

Securing a difficult money loan can be a structured procedure, specifically for those who recognize the required actions included. A consumer must collect relevant monetary files, including income statements and credit score history. This financial background assists lending institutions analyze the borrower's ability to pay back. Next off, the customer requires to identify a proper home to use as security, as Hard money Loans are mainly safeguarded by property. Once the home is picked, the debtor sends a loan application together with the residential property information. Following this, loan providers commonly conduct a home assessment to identify its worth. Finally, upon approval, the debtor assesses the finance terms before signing the contract, finishing the application process effectively.

Assessing Lenders: What to Look For in a Difficult Cash Lender

When evaluating prospective loan providers for a difficult cash loan, what vital elements should customers take into consideration to assure they select a credible partner? Consumers ought to analyze the lender's online reputation, looking for reviews, testimonies, and successful case researches. Transparency is necessary; lenders must provide clear info pertaining to fees and procedures. Additionally, checking out the lender's experience in the Hard money market can suggest their integrity and understanding of the industry. Customers must additionally think about the loan provider's responsiveness and customer care, as effective interaction can substantially impact the car loan procedure. Understanding the lending institution's funding sources and their determination to tailor Loans to certain scenarios can aid safeguard a productive partnership. A comprehensive examination promotes a much more safe and secure borrowing experience.

Rates Of Interest and Terms: What Debtors Must Expect

Understanding the landscape of rates of interest and terms is essential for debtors looking for Hard money fundings, as these aspects can significantly impact the general price and usefulness of the funding. Hard money Loans typically include greater passion rates compared to standard car loans, typically ranging from 8% to 15%. The terms of these Loans are normally short, usually in between six months to five years, reflecting the short-term nature of the financing. Furthermore, lending institutions might call for points, which are ahead of time charges determined as a portion of the car loan quantity. Debtors must likewise recognize potential early repayment charges and the significance of a clear settlement plan. All these elements must be thoroughly taken into consideration to ensure a well-informed loaning choice.

Tips for Effective Borrowing: Optimizing Your Hard Money Loan Experience

For consumers intending to maximize their Hard cash lending experience, cautious prep work and critical preparation are essential. First, comprehending the terms of the loan can protect against costly surprises later. Borrowers ought to likewise carry out detailed study on potential lenders, contrasting interest fees, prices, and online reputations. Developing a clear objective for the loan, such as a specific investment project, permits concentrated conversations with loan providers. Additionally, having a solid leave strategy in position can reassure loan providers of the debtor's commitment to payment. Maintaining clear communication and providing needed documentation quickly can foster a favorable relationship with the loan provider, which might lead to more favorable terms in future purchases.

Often Asked Questions

What Types of Residence Get Approved For Hard Money Loans?

The types of buildings that get approved for Hard money Loans commonly include houses, commercial buildings, fix-and-flips, and land. Direct Hard Money Lenders. Lenders analyze the residential or commercial property's worth and possibility commercial instead of the debtor's credit reliability

How Quickly Can I Receive Funds After Approval?

After approval, consumers typically receive funds within a few days, depending upon the loan provider's procedures and the debtor's responsiveness. Quick turn-around is a vital benefit of Hard cash Loans contrasted to typical funding alternatives.

Can Hard Money Loans Be Used for Commercial Properties?

Hard money Loans can undoubtedly be made use of for business residential properties. Financiers frequently favor these Loans for their rate and adaptability, allowing quicker access to funding for my site acquiring or see renovating different sorts of industrial property.

What Happens if I Default on a Hard Money Finance?

If one defaults on a hard cash financing, the lending institution commonly launches repossession proceedings. The property might be confiscated, leading to loss of equity and prospective legal repercussions, greatly influencing the debtor's monetary standing and credit report.

Are Hard Money Loans Available for First-Time Debtors?

Hard money Loans can be obtainable to newbie consumers, though terms might vary by lender (Direct Hard Money Lenders). These Loans frequently prioritize home worth over credit score background, making them an option for those with restricted loaning experience

Next off, the customer needs to recognize an appropriate residential or commercial property to make use of as security, as Hard money Loans are largely secured by real estate. When examining possible lending institutions for a hard money funding, what vital elements should consumers take into consideration to assure they pick a credible companion? Recognizing the landscape of interest rates and terms is vital for debtors looking for Hard cash loans, as these factors can considerably impact the overall cost and feasibility of click for more info the financing. Hard cash Loans usually feature higher rate of interest rates compared to traditional fundings, commonly ranging from 8% to 15%. Hard money Loans can be easily accessible to novice customers, though terms may differ by lender.